Listen online to 650 CKOM’s live coverage of Budget Day in Saskatchewan.

Saskatchewan consumers will be hit again in this year’s budget as more changes are being made to the provincial sales tax (PST).

It’s one of the initiatives provincial Finance Minister Donna Harpauer announced Tuesday as Saskatchewan works to return to a balanced budget by the end of the next fiscal year.

The provincial government will spend $1 million a day more than it will bring in the 2018/19 fiscal year, so it’s looking to make some of that up.

Starting Wednesday, PST will be applied on used vehicles. That’s a $600 cost on a $10,000 car purchase, which will be paid during registration with SGI.

“We felt this was one area that isn’t going to impact our economy. Investors looking into our province aren’t going to look at whether there’s PST on used vehicles,” Harpauer told reporters Tuesday.

There are exceptions though — any sale under $5,000 won’t be taxed.

A sale to certain family members — including spouses, parents or legal guardians, children, grandparents, grandchildren or siblings — will also be tax free.

PST will also be applied to appliances with the energy star sticker, meaning customers will pay six per cent on most appliances that were tax free until now.

The half-point cut in personal income tax promised for this year is on hold, along with indexing personal income tax to the rate of inflation.

Some people will also now pay extra on utility bills.

While many already pay a three per cent SaskEnergy surcharge each month — which goes to local government — that’s going up to five per cent. It’ll mean an extra $18 a year on average.

In communities where the surcharge wasn’t applied, people could now see the five per cent increase on their bill — unless the municipality chooses to opt out. It will mean an extra $45 a year on average.

The provincial government said this ensures fairness across Saskatchewan. The changes are expected to bring $22 million more to municipalities.

The big 3: health, education & social services

The Ministry of Health once again takes up the largest portion of spending at $5.77 billion.

The money includes the long-promised $2.4 million to help children with autism, which amounts to $4,000 per child under the age of six to get individual assistance.

There will also be universal full coverage of HIV drugs and all babies will be tested for hearing loss.

Funding for K-12 education is up $30 million as per Premier Scott Moe’s promise in his leadership campaign. It will allow for hiring 400 more teachers or other supports such as educational assistants.

Despite the extra 30 million, overall education funding, which includes early childhood education and post-secondary of $3.26 billion, is down 7.6 per cent.

That’s due, in part, to less funding for teacher benefits and pensions.

Social Services spending rises to $1.38 billion, an indication of increasing need. It includes more for care for mental health, adults with intellectual disabilities and foster families.

The government is again promising a review of social services programs.

Rural crime & municipal money

On top of the Protection and Response Team announced last fall, which added 258 armed officers in rural areas, there is $4.9 million in new money from SGI.

It will fund 30 more police officers, however, it’s not clear how exactly they will deal with crime as it’s specifically targeted to traffic safety.

“The additional officers will be an additional presence on the road, because that is something we hear from rural Saskatchewan,” Harpauer said.

“It’s extremely challenging for RCMP – there’s a lot of roads in Saskatchewan, so it’s hard for them to be seen on each and every one.”

The province expects to make $600,000 more this year from traffic fines. Prior to the budget, SGI announced fines will increase starting May 1.

Last year, cities and towns were upset then they lost money from grants-in-lieu paid by Crown corporations instead of property tax.

The province reviewed the issue following backlash. This year, SaskPower and SaskEnergy will return to paying out grants to communities for things like office buildings.

Harpauer said people in communities that were already paying the five per cent surcharge won’t see a difference.

“What will be different is (last year), those revenues were directed to the provincial revenue fund, rather than the municipality where they lived.”

Municipal revenue sharing continues based on one point of the PST.

That’s falling by $21 million, or about five per cent, in part because of less PST revenue.

There may not be as many jobs with Crowns or executive government and people who already work there may find vacant positions stay that way.

The Moe government plans to save $35 million in each of the next two years in those areas. It could be through attrition, managing vacancies that arise and overtime.

“We have found, in the past, where we can find efficiencies just in reducing overtime – that may actually (mean) hiring more people,” Harpauer said, adding each manager will decide how best to meet the restrictions.

“Some may meet it and more. Others may not be able to meet it. We’re looking for the big picture on how we can manage this.”

The province has given up on last year’s plan to save $250 million on forced savings in the public sector.

Highway work

New work this year includes twinning and passing projects on highways 6 and 39 south of Regina, and passing lanes on highway 4 between North Battleford and Cochin.

Planning will begin for passing lanes west of Rosetown on Highway 7 to the Alberta border and highways 9 and 10 between Melville and Canora.

Similar work will be done on Highway 5 from the junction of Highway 2 to Saskatoon.

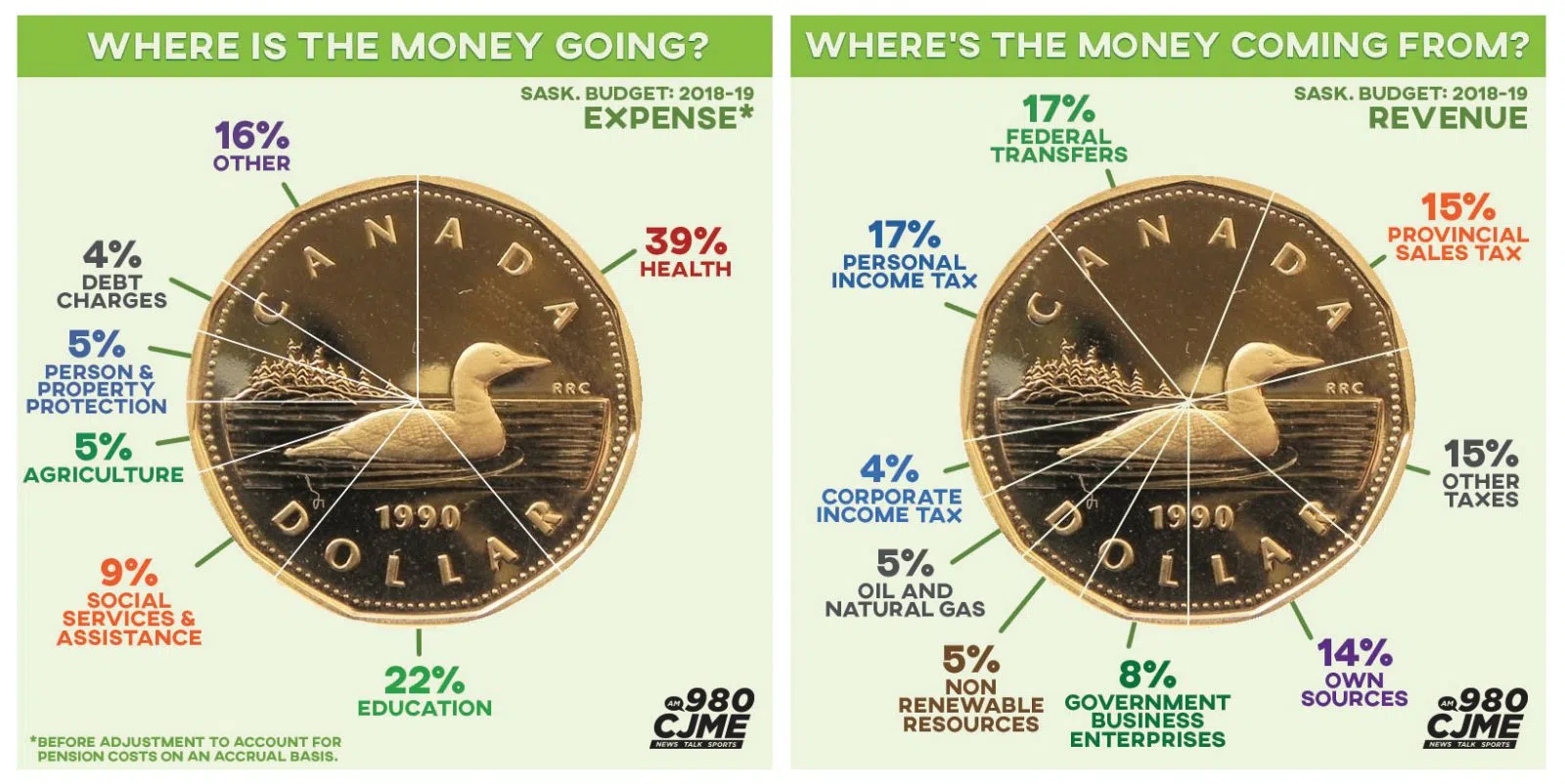

In the fiscal year 2018/19, revenue will top $14.24 billion with spending at $14.6 billion.

The deficit will end at $365 million and debt continues to climb by $2 billion, topping $20 billion.