By

A forensic audit of the Federation of Sovereign Indigenous Nations (FSIN) that flagged over $30 million in expenditures is complete.

The finalized report covering the period from April 1, 2010, to March 31, 2024, was conducted by Indigenous Services Canada (ISC) and administered by KPMG. In it, the government made eight recommendations including a review of all policies related to travel expenditures and better documentation of financial spending.

Read more:

- FSIN audit questions over $34 million in expenses

- New Indigenous-led virtual health hub is a model for rest of Canada

- Indigenous Services Canada to conduct forensic audit of James Smith Cree Nation

There is no mention of any criminal charges.

The figures, which were first published by paNOW on Sept. 12, revealed $3,732,982 as ineligible program expenditures, $30,362,990 in spending was flagged as questionable, and $155,595 as unsupported. Some expenditures were determined to be non-compliant with the terms and conditions of government funding.

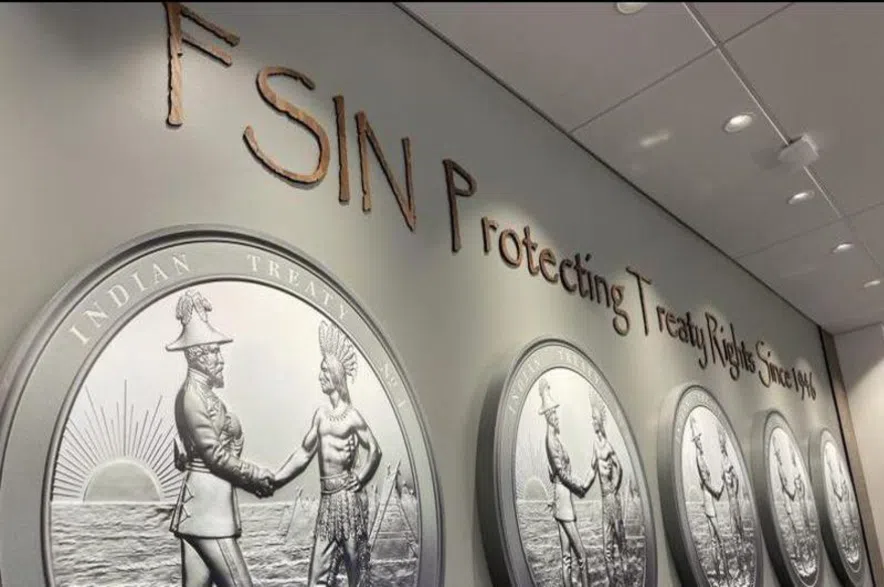

According to the ISC’s final report, the reasons for the audit included allegations of a lack of transparency, increases to FSIN executive pay, travel expenditures and the FSIN’s new office building.

A large portion of the money flagged in the report is in regard to the $30,024,786 the FSIN received in COVID-19-related funding.

“Expenditures were categorized as questionable in the amount of $23,451,907 where we were unable to obtain complete supporting documentation to determine eligibility,” the ISC said.

“Including a potential recovery of $60,335 in ineligible expenditures and $1,050 in unsupported expenditures.

In total, 34 samples reviewed, totalling $2,618,336, did not appear to have appropriate approval.

Funding flow

The FSIN is a body through which federal funds can flow through to other groups and organizations. The audit recommended the FSIN do the following:

- The FSIN should collect budgets from groups and organizations that it passes funds onto, to ensure the activity meets funding requirements.

- The FSIN should document purchases made for the organization to receive the funds, including authorization.

- Invoices and other documentation should be collected from the organizations being provided funding by the FSIN, to show actual expenditures align with the planned budget. In the case of variances, document reasons and determine whether they are eligible under funding agreements.

- The FSIN should consider tracking expenditures with a funding letter to present how ISC funding was spent, which will also help determine funding eligibility.

The audit flagged other issues, including: $3,000 in travel costs from a vice chief on unpaid leave. Roughly $48,000 in travel expenses without explanation and large pay raises for FSIN executives.

A briefing note prepared for the FSIN’s treasury board on Nov. 5, 2020, recommended a $60,000 increase to the Chief’s remuneration and a $40,000 increase to the Vice-Chiefs. But it’s undetermined if the pay increases included retroactive pay. If back pay was not included, then it’s possible the executive members were overpaid by $147,000.

Of the total amount, $7.9 million was tagged for administrative fees without supporting paperwork. Nearly $1 million was spent on a new office for the FSIN.

The Canadian government said that in the future, the FSIN needs to review its travel policy and ensure all trips are approved in advance. Administrative fees should also be tracked—as the audit recommended—to a separate department.

The FSIN leadership has not responded to numerous requests for comment. The RCMP was not immediately available for comment on whether a criminal investigation is underway.