People in Melville might have to find a new bank after the BMO Bank of Montreal announced it will close its doors in the city next June.

Melville’s mayor, Joe Kerwan, said he’s concerned for some of the senior citizens in the community.

“They have done their banking forever by walking into the branch and dealing with a person behind the counter, and that change for them is going to be extremely difficult,” he said.

Read more:

- Avonlea woman who won ‘life-changing’ VLT jackpot of nearly $900k plans to retire early

- ‘Catastrophic’: Patient speaks out after Regina medical clinic closes its doors

- Ituna Theatre in ‘safe hands’ with local buyers, says former owner

He said the announcement came as a total surprise; the city was unaware of the closure until residents started voicing their concerns to Kerwan in the grocery store or over the phone.

“The few people who have talked to me are upset,” he said.

As for Kerwan, he shares similar feelings of anger and disappointment.

“They’ve been part of our community for a very long time,” he explained.

“Human beings are very much brand loyal. And folks who have been dealing with the Bank of Montreal for a long time are going to find it very difficult.”

Customers are being welcomed to the Yorkton BMO branch — which is around 40 km northeast of Melville —but Kerwan is worried this won’t be feasible for everyone.

“We have a fairly large contingent of senior citizens who may not be doing online banking or telephone banking, and may find it difficult to get to Yorkton to do some of their banking,” he said.

While there are several concerns, Kerwan said there isn’t much the city council can do.

“We really have no influence with the Bank of Montreal corporate office,” he said.

He met with the executive director of the Chamber of Commerce Tuesday morning, and he plans to write a letter to BMO expressing the city’s concerns.

Melville also has two other banks, including Royal Bank Canada and Cornerstone Credit Union.

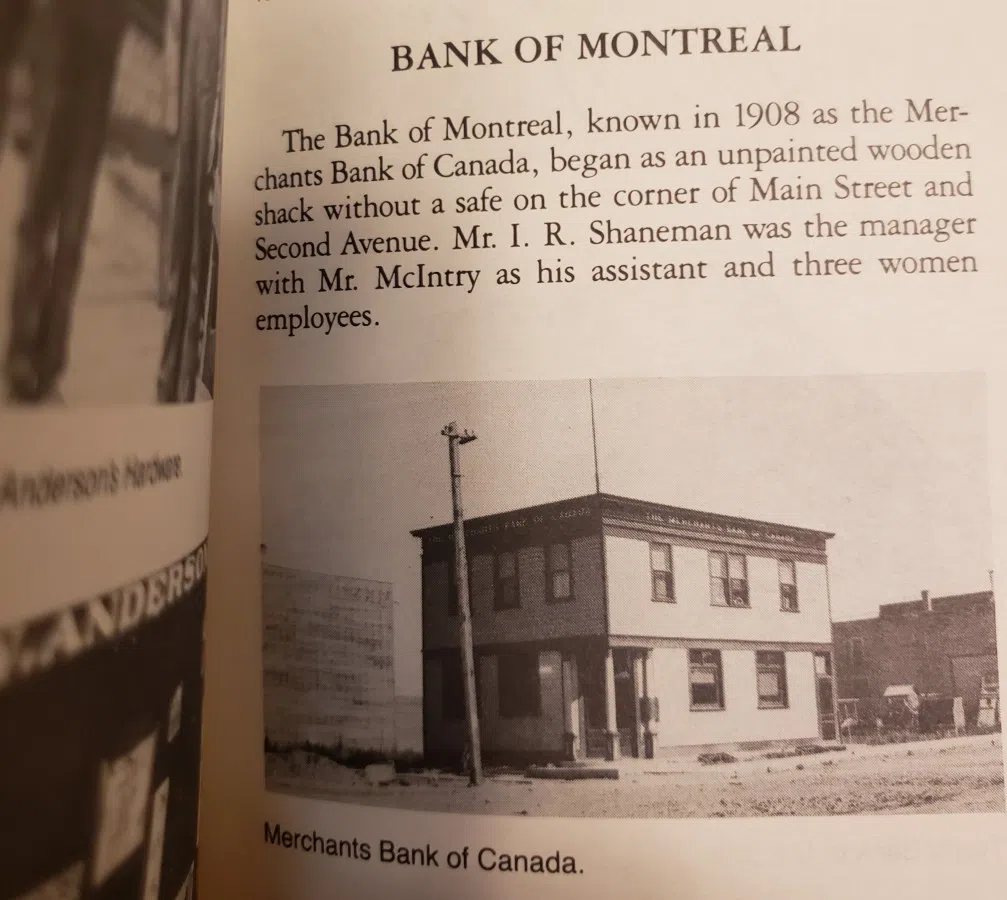

The BMO bank has a rich history in Melville. (The Ties That Bind, Melville’s history book/Submitted)

Closures not a new trend

Earlier this year, BMO closed its location in Davidson and, closed its Weyburn branch in 2024.

Jason Childs, University of Regina professor of economics, said this isn’t a new trend.

“I believe it is tied in with the shift toward online banking and the more general automation of banking services,” he said.

He said BMO is looking to change their business model to “boost or protect profits.”

“Branches aren’t cheap to run, and more and more they simply tell you to use the website or call the 1-800 number,” he said.

Childs’ also noted that with the urban population of Saskatchewan and Canada growing, banks have less incentive to stay in smaller communities.

But, he said this could provide an opportunity for credit unions to expand their more personal and local focus.

Options for BMO customers

In a statement from BMO, it said decisions to close branches are “carefully considered.”

“We will ensure clients can transition smoothly and look forward to providing support,” the statement read.

It said there are a number of options for customers to explore, like mobile and telephone banking, a virtual personal banker and digital demos which teach people how to pay bills online, transfer money, deposit a cheque and send money.

“We encourage any client who wants help gaining confidence with any of our alternative banking options to book an appointment with our Melville team at their earliest opportunity,” BMO said.

Read more: